Singaporean and Hong Kong Banking Experience | Original

Updated in September 2025.

Table of Contents

- HSBC Debit Card Retention Incident

- Card retained accidentally at ATM

- HSBC support via WhatsApp/app

- Replacement card mailed within week

- Opening an OCBC Bank Account

- Requires Chinese passport/ID only

- Digital app simplifies verification process

- Includes 360 Account with rewards

- Card activation requires branch visit

- Account risks closure without activity

HSBC Debit Card Retention Incident

I got my HSBC Debit card in May 2023 at the Sha Tin branch in Hong Kong. Unfortunately, just at the ATM outside the branch, my card was retained.

After learning some basic operations, I was going to take back my card from the machine. However, my daughter was playing and wanting to touch that card. Suddenly, the card was retained.

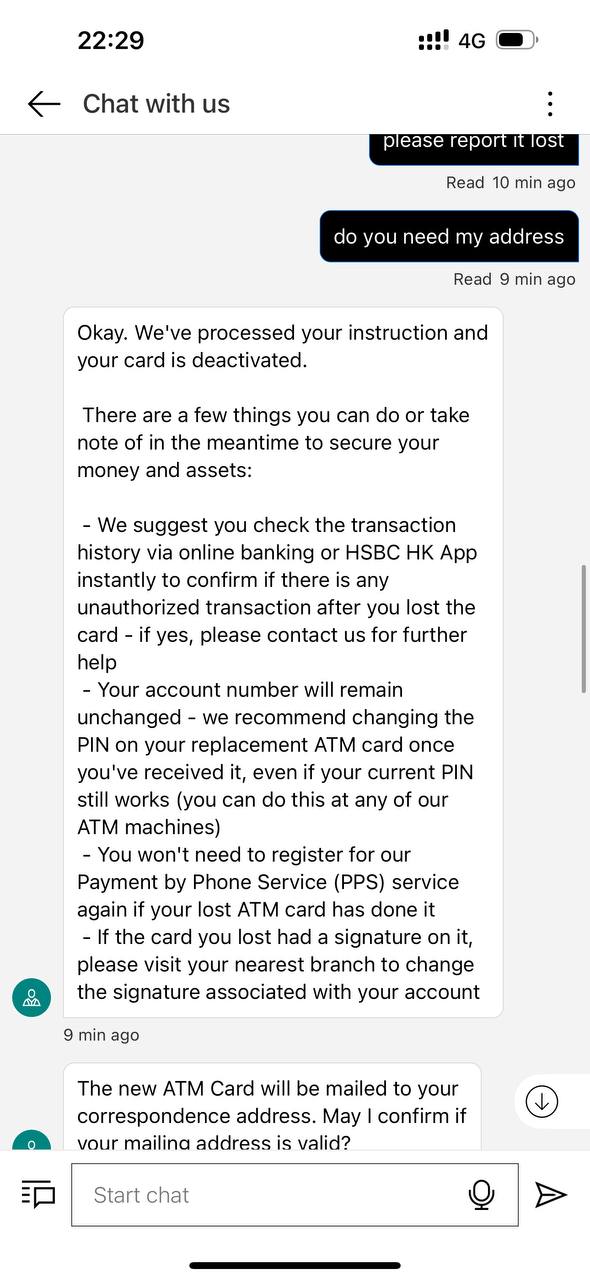

So this is in July 2025. I used WhatsApp to chat with HSBC first. Later, I was told to use the HSBC HK app to talk with them.

They told me something like:

Thank you for your patience, Mr. Li. After checking, we found that there is an ATM card in your name with a card production record on May 19, 2023. If you have not received this card, we can report it lost and reissue a new card for you.

Do you need us to report it lost and reissue a new card for you?

Okay. We’ve processed your instruction and your card is deactivated.

There are a few things you can do or take note of in the meantime to secure your money and assets:

- We suggest you check the transaction history via online banking or the HSBC HK app instantly to confirm if there is any unauthorized transaction after you lost the card—if yes, please contact us for further help.

- Your account number will remain unchanged—we recommend changing the PIN on your replacement ATM card once you’ve received it, even if your current PIN still works (you can do this at any of our ATM machines).

- You won’t need to register for our Payment by Phone Service (PPS) again if your lost ATM card has done it.

- If the card you lost had a signature on it, please visit your nearest branch to change the signature associated with your account.

Our ATM cards are sent by normal mail. There is no tracking number.

Generally, it takes within a week to mail to a Hong Kong address, and for overseas addresses, it takes 7-11 working days, depending on the mailing time.

I hope this time we can do it. Let’s wait for the new card.

Source: Self-screenshot

Source: Self-screenshot

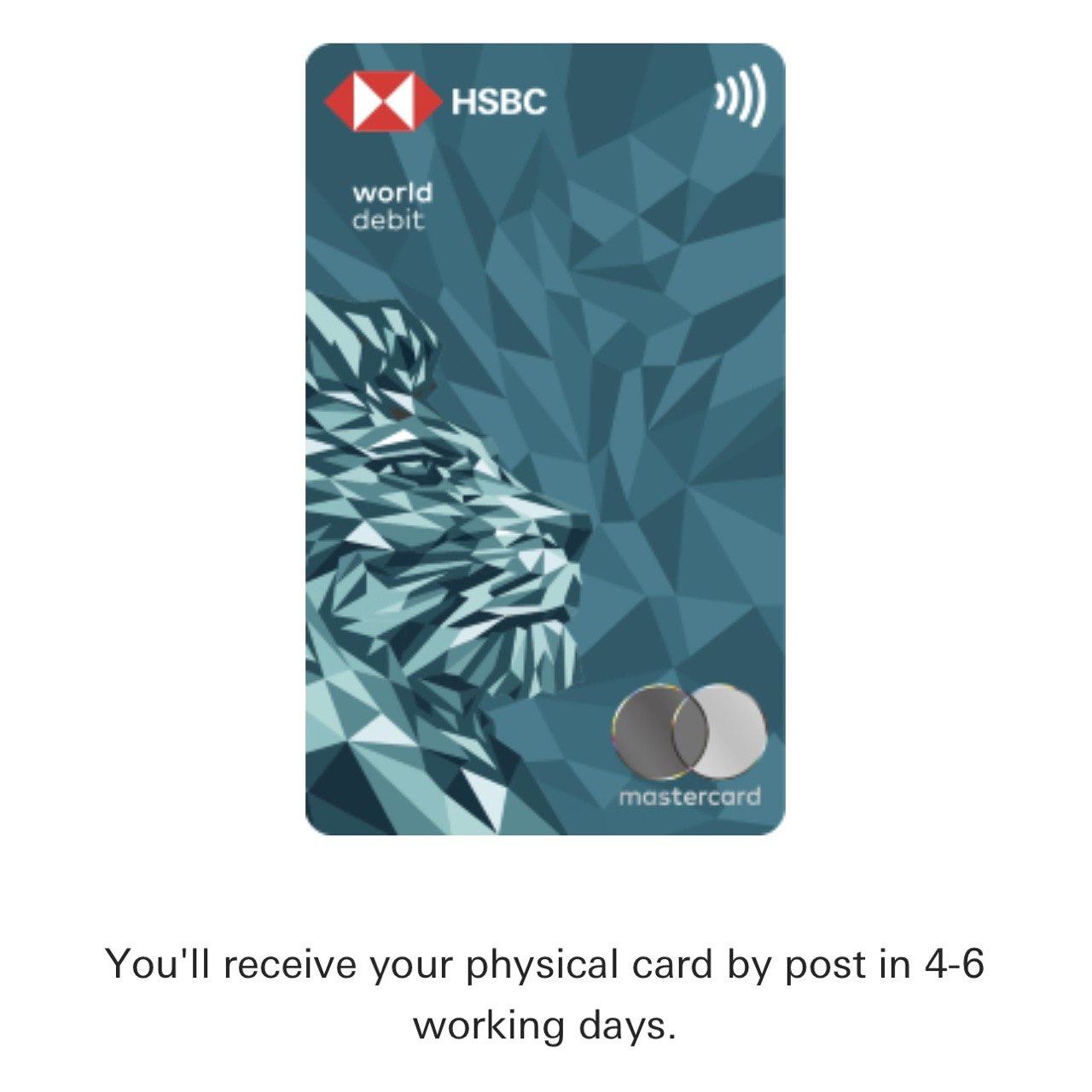

I received the card around August 14, 2025. It was great. I tried two HSBC ATM machines in Guangzhou: one at Taikoo Hui and one at Tianhe City. I started learning the details of the product and how to use it effectively to help my life. I also tried to apply for the HSBC World Debit Card.

The card I received is called the HSBC UnionPay Debit Card. However, when I went to a 7-Eleven store to buy a drink, I tried several times with the help of the staff, but we couldn’t successfully use my HSBC UnionPay Debit Card. I still don’t know the reason. Later, I increased the limits in the app. I will try again at another time.

Source: Self-screenshot

Source: Self-screenshot

Opening an OCBC Bank Account in China

2024.07.12

This blog post was written with the assistance of ChatGPT-4o.

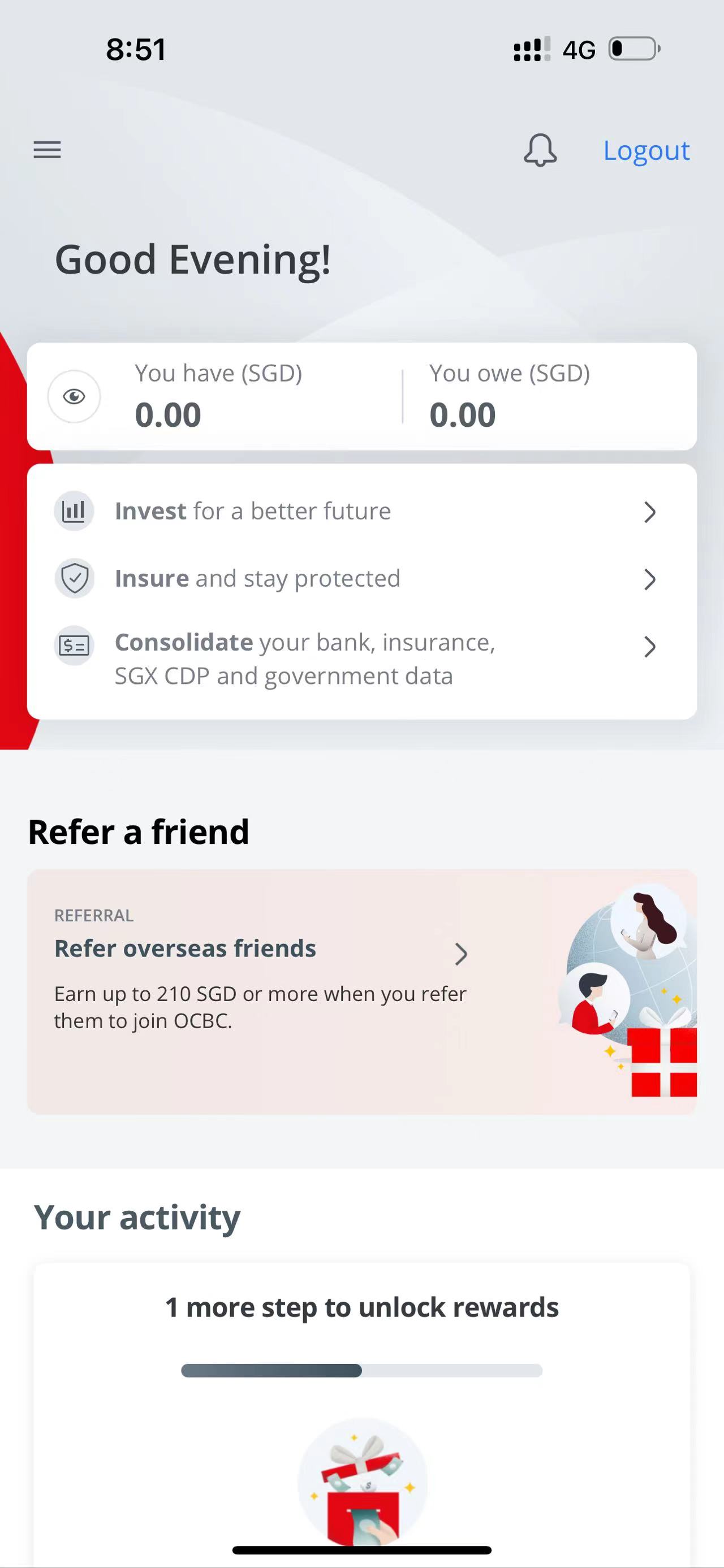

In today’s digital age, managing finances and accessing cloud services has become more straightforward than ever. If you’re a Chinese national with a Chinese passport and Chinese Identity Card, opening a bank account with OCBC Digital and using it to register for Google Cloud Platform is a seamless process. Here’s a step-by-step guide to help you through the process.

Step 1: Open an OCBC Bank Account

Requirements:

- Chinese Passport

- Chinese Identity Card

Procedure:

- Download the OCBC Digital App:

- Head to the App Store or Google Play Store and download the OCBC Digital app.

- Sign Up:

- Open the app and select the option to sign up for a new account. You will be prompted to provide your personal information, including your Chinese passport and Identity Card details.

- Verification:

- OCBC will require you to verify your identity. This might involve taking a photo of your passport and Identity Card, as well as a selfie for facial recognition.

- Account Selection:

- During the registration process, choose to open both a Global Savings Account and a Statement Savings Account. These accounts will help you manage your finances effectively.

- Opening a 360 Account:

- Additionally, opt to open a 360 Account. This account offers various benefits and rewards based on your spending and saving activities. When you open a 360 Account, you will also receive a debit card linked to this account.

- Complete the Process:

- Follow the on-screen instructions to complete the account opening process. You might be required to visit a branch for final verification, depending on your situation.

Step 2: Activate Your Debit Card

- Receive and Activate Your Debit Card:

- Once your 360 Account is set up, you will receive an OCBC debit card. You can activate it online through the OCBC Digital app or by visiting the OCBC website.

Conclusion

Opening a bank account with OCBC Digital using a Chinese passport and Identity Card is a straightforward process. By setting up your Global Savings Account, Statement Savings Account, and 360 Account, and obtaining a debit card, you can easily manage your finances. Additionally, using your OCBC debit card to register for Google Cloud Platform provides a smooth gateway to accessing powerful cloud services. Embrace the convenience and start managing your finances and cloud services effortlessly today.

Update - December 2014

I deposited a few hundred SGD into my OCBC account. However, I did not receive the physical card. I received an email from the bank notifying me that I need to visit a Singapore OCBC branch, or they will close my account.

Update - August 2025

I started to use again in August 2025. I can activate the debit card of OCBC Bank account.